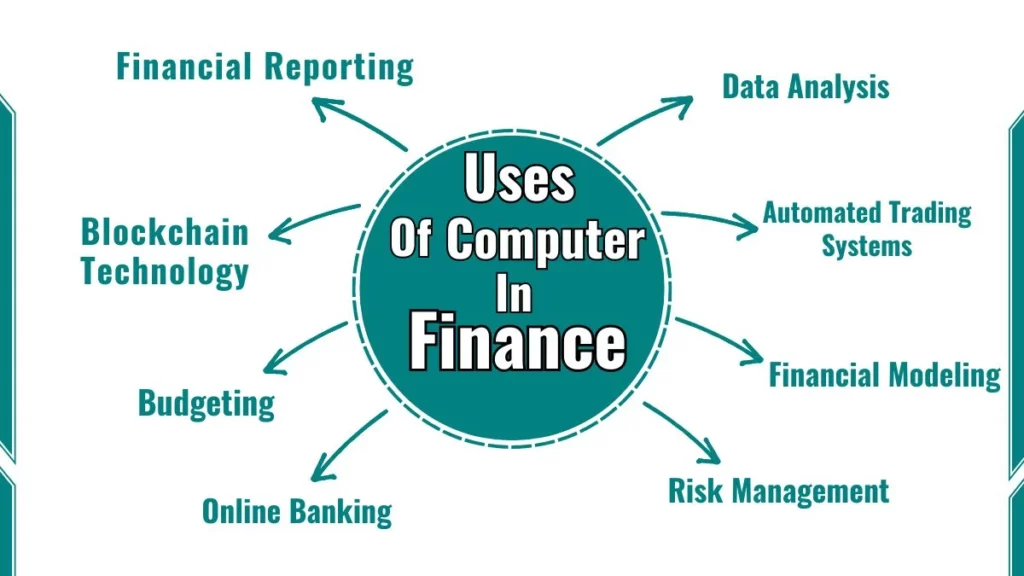

Learn the different uses of computers in finance and how they have transformed how we manage and understand money.

Computers play an important role in finance, from data analysis to automated trading systems. They help with tasks like risk management, financial modelling, and online banking, making processes faster and more efficient.

Role of Computers in Finance

The following are the different uses of computers in finance:

1. Data Analysis and Management

Finance runs on data. Computers help manage this data. They can handle huge amounts of information quickly. Banks and companies use special software for this. They also use common tools like Excel. These help them understand trends and make smart choices about money.

2. Automated Trading Systems

Computers have changed how we buy and sell stocks. We now have algo-trading. This means computers follow set rules to trade. They can make trades very fast. Much faster than humans can. This makes the market move more smoothly. It can also find small chances to make money that humans might miss.

3. Financial Modeling

Computers help create models of how money might work in the future. This is called financial modeling. People use special programs for this. Some popular ones are MATLAB and R. These tools help predict what might happen in the market. They can test different scenarios. This helps investors and companies plan better.

4. Risk Management

Managing risk is a big part of finance. Computers are very good at this. They use complex math to figure out possible risks. They can show what might happen if the market changes. This helps banks and investors make safer choices. It helps them know how much risk they’re taking.

5. Online Banking

Online banking has changed how we use our money. We can now check our accounts anytime. We can send money or pay bills from our phones. This is all thanks to computers. Banks use strong security to keep our money safe online. This makes banking easier and safer for everyone.

6. Budgeting and Forecasting

Computers help us plan how to use our money. There are apps for personal budgets. Companies use more complex software. These tools help track spending. They can show where money is going. They also help predict future costs and income. This makes it easier to set and reach financial goals.

7. Customer Relationship Management (CRM)

Finance is about relationships too. CRM systems help manage these relationships. They keep track of customer information. They remember past conversations. This allows banks and advisors to give better service. They can offer more personal advice. This makes customers happier and more loyal.

8. Blockchain Technology

Blockchain is a new way to record information. It’s very secure and open. It’s the technology behind Bitcoin. But it can do much more. It could change how we keep financial records. It might make some money transfers faster and safer. Many banks are looking at how to use blockchain.

9. Financial Reporting

Computers make financial reports easier. They can create reports quickly. These reports are often more accurate than handmade ones. Computers can check for mistakes. They make sure everything follows the rules. This is important for big companies. It helps them stay out of trouble with regulators.

10. Education and Training

Learning about finance is easier with computers. There are many online courses about money. Some are for beginners. Others are for experts. There are also fake trading systems. These let people practice investing without real money. This helps more people learn about finance. It’s good for students and professionals.

Conclusion

Computers have made big changes in finance. They’ve made things faster and often safer. They help us understand complex money matters. From analyzing data to making trades, computers are key. They’re changing how we learn about money too.

New technology keeps coming. Things like artificial intelligence will bring more changes. This means finance will keep evolving. It’s an exciting time for anyone interested in money and technology.

Also Read:

| Uses of Computers in Transportation | Uses Of Computers in Education |

| Uses of Computers in the Agriculture Field |